Fascination About Eb5 Investment Immigration

The Best Guide To Eb5 Investment Immigration

Table of ContentsOur Eb5 Investment Immigration IdeasLittle Known Questions About Eb5 Investment Immigration.Rumored Buzz on Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.About Eb5 Investment Immigration

While we make every effort to offer exact and updated web content, it ought to not be taken into consideration lawful advice. Migration laws and policies are subject to change, and individual circumstances can differ extensively. For customized advice and legal guidance regarding your certain migration circumstance, we highly advise seeking advice from a qualified immigration lawyer that can supply you with tailored help and guarantee conformity with present regulations and regulations.

Citizenship, with financial investment. Currently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Employment Areas and Backwoods) and $1,050,000 in other places (non-TEA areas). Congress has actually authorized these quantities for the following five years starting March 15, 2022.

To get approved for the EB-5 Visa, Financiers should create 10 full time U.S. work within two years from the date of their complete investment. EB5 Investment Immigration. This EB-5 Visa Need makes sure that financial investments add straight to the united state task market. This uses whether the tasks are created straight by the company or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

All about Eb5 Investment Immigration

These jobs are established with versions that use inputs such as growth costs (e.g., construction and tools expenditures) or yearly revenues produced by ongoing procedures. On the other hand, under the standalone, or straight, EB-5 Program, just direct, permanent W-2 staff member positions within the company may be counted. A key danger of relying exclusively on direct staff members is that personnel reductions due to market problems could result in inadequate permanent settings, possibly resulting in USCIS rejection of the financier's petition if the job creation need is not met.

The financial model after that forecasts the number of straight jobs the new organization is likely to develop based upon its anticipated profits. Indirect jobs calculated through financial models describes work generated in markets that provide the products or services to the business directly included in the task. you could look here These work are developed as an outcome of the boosted demand for products, products, or solutions that sustain business's operations.

Fascination About Eb5 Investment Immigration

An employment-based fifth preference group (EB-5) investment visa offers an approach of ending up being a long-term united state homeowner for international nationals wishing to spend resources in the United States. In order to use for this environment-friendly card, a foreign capitalist needs to spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Location") and develop or maintain at the very least 10 full-time tasks for United States workers (excluding the investor and their prompt household).

Today, 95% of all EB-5 capital is raised and invested by Regional Centers. In many regions, EB-5 financial investments have actually filled the funding void, offering a new, important source of capital for regional economic development tasks that renew areas, create and sustain tasks, facilities, and services.

Not known Facts About Eb5 Investment Immigration

More than 25 nations, including Australia and the United Kingdom, use comparable programs to attract international investments. The American program is a lot more rigid than many others, needing substantial danger for capitalists in terms of both their monetary investment and migration status.

Family members and individuals who seek to transfer to the United States on a long-term basis can obtain the EB-5 Immigrant Capitalist Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) set out various needs to obtain long-term residency through the EB-5 visa program. The needs can be summarized as: The financier check it out has to meet capital expense amount demands; it is generally needed to make either a $800,000 or $1,050,000 capital expense amount into a UNITED STATE

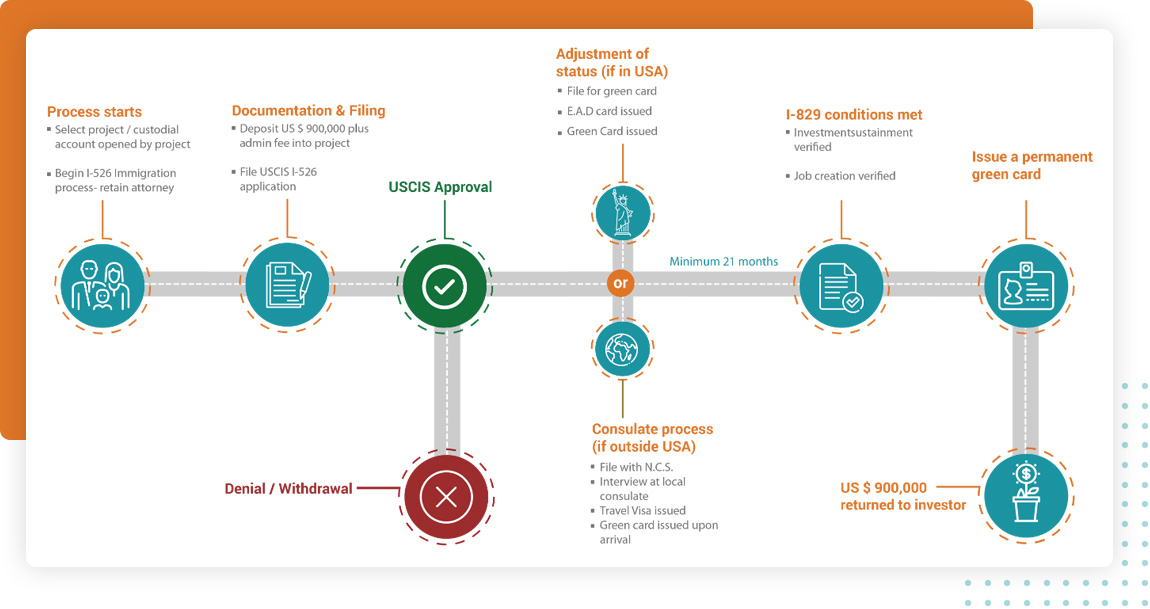

Talk to a Boston immigration lawyer about your requirements. Right here are the basic actions to acquiring an EB-5 financier eco-friendly card: The very first step is to locate a qualifying investment chance. This can be a brand-new company, a regional facility task, or an existing business that will be increased or restructured.

Once the chance has been determined, the financier should make the investment and send an I-526 request to the U.S. Citizenship and Immigration Services (USCIS). This request needs to consist of evidence of the investment, such as financial institution statements, purchase contracts, and company plans. The USCIS will assess the I-526 request and either accept it or demand added evidence.

The Greatest Guide To Eb5 Investment Immigration

The investor should obtain conditional residency by sending an I-485 request. This petition needs to be sent within six months of the I-526 authorization and need to include proof that the investment was made and that it has actually developed at the very least 10 permanent tasks for U.S. workers. The USCIS will review the I-485 request and either approve it or demand extra evidence.